Let’s face it – life can throw some curveballs. Whether it’s a job loss, unexpected bills, or a natural disaster, financial struggles can happen to anyone. But here’s the good news. If you’re a homeowner feeling the squeeze, there’s a lifeline that many people don’t realize is still available: mortgage forbearance.

What Is Mortgage Forbearance?

As Bankrate explains:

“Mortgage forbearance is an option that allows borrowers to pause or lower their mortgage payments while dealing with a short-term crisis, such as a job loss, illness or other financial setback . . . When you can’t afford to pay your mortgage, forbearance gives you a chance to sort out your finances and get back on track.”

A common misconception is that forbearance was only accessible during the COVID-19 pandemic. While it did play a significant role in helping homeowners through that crisis, what many people don’t know is that forbearance is still a tool to support borrowers in times of need. Today, it remains a vital option to help homeowners in certain circumstances avoid delinquency and, ultimately, foreclosure.

The Current State of Mortgage Forbearance

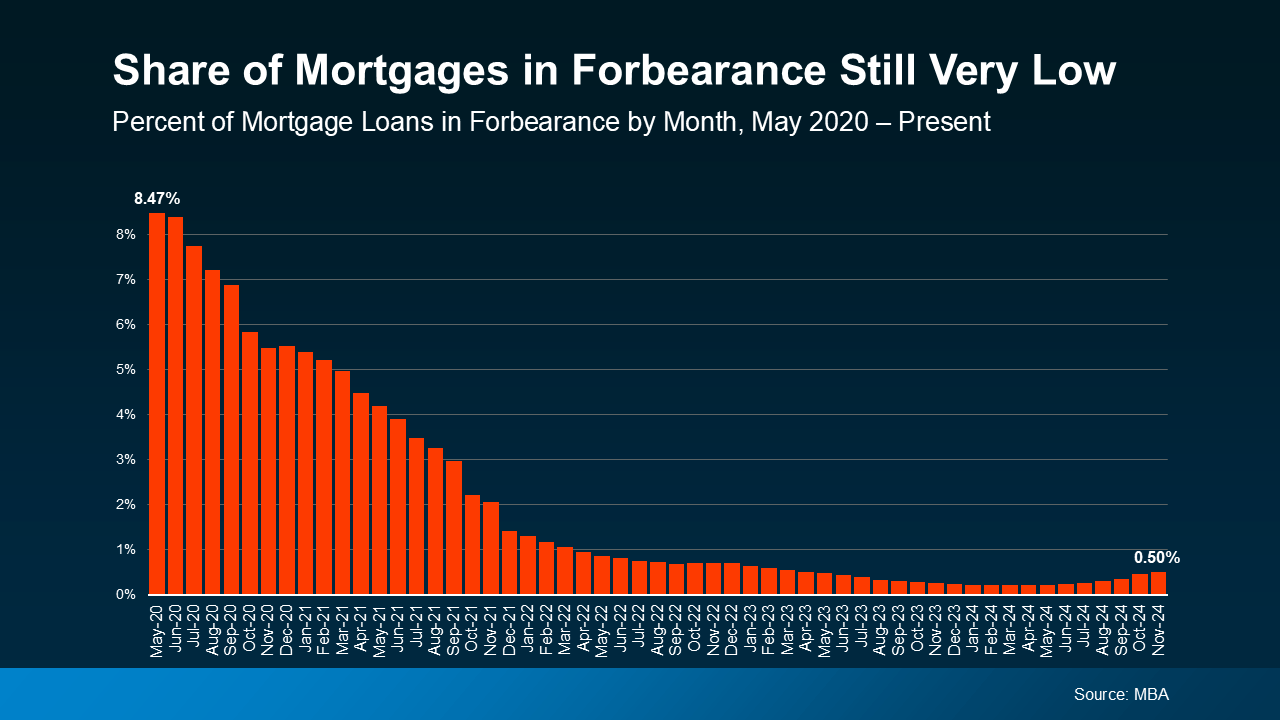

Forbearance continues to serve as a valuable safety net for homeowners facing temporary financial challenges. While the overall rate of forbearance has seen a slight increase recently, it’s important to understand what’s driving this change and how it fits into the broader picture.

According to Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA):

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

This may seem concerning at first glance, but let’s break it down. The graph below, going all the way back to 2020, puts things into perspective:

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

Natural disasters like these often create temporary financial hardships for homeowners, making forbearance a crucial safety net during recovery. In fact, 46% of borrowers in forbearance today cite natural disasters as the reason for their financial struggles.

Even with the most recent uptick, the share of mortgages in forbearance is nowhere near pandemic levels, and, thankfully, reflects a very small portion of homeowners overall.

Why Forbearance Matters

Forbearance can help borrowers avoid the spiral of missed payments and foreclosure. It provides breathing room to address challenges and plan next steps. And while most homeowners today are not in a position to need forbearance, thanks to strong equity and foundations of the current housing market, it is an option for the few who do need it.

If you or a homeowner you know is facing financial difficulties, the first step is to contact your mortgage lender. They can walk you through the forbearance process and help you understand your options. Keep in mind that forbearance is not automatic — you need to apply and discuss the terms with your lender.

Bottom Line

In tough times, knowing your options can bring peace of mind. Forbearance isn’t just a financial tool — it’s a lifeline. And while the recent increase in forbearance rates might make headlines that give you pause, the truth is this option is working exactly as it should: helping those who need it most get through difficult moments without losing their homes.